The importance of staying invested

Throughout the years, our message as Octagon Financial has consistently been ‘stay invested’. No matter what the markets are doing, no matter what you’ve heard through the grapevine, and no matter what your brother’s investor friend told him on the golf course, the ‘long game’ investment strategy is the one that delivers the best rewards.

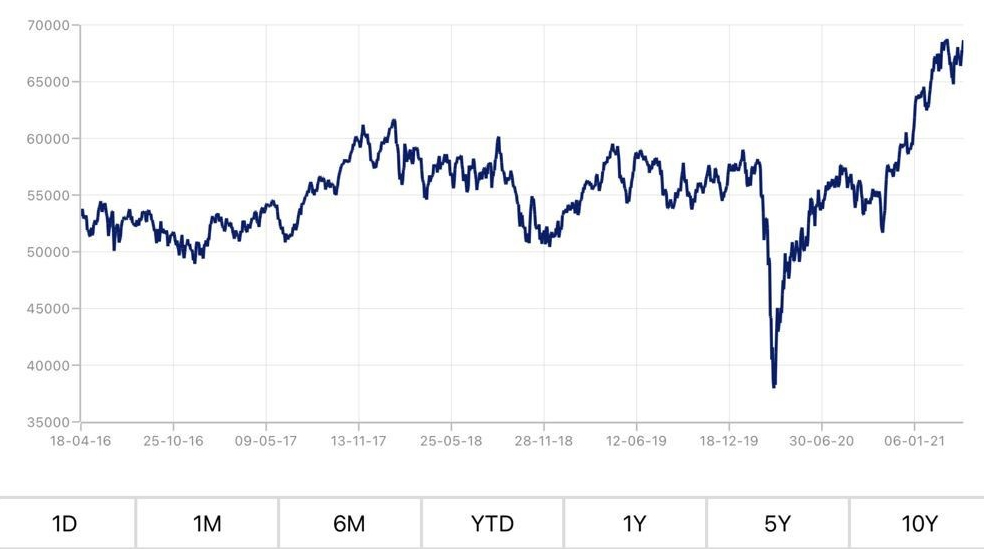

The proof really is in the pudding. Look at this data from Sharenet, captured over a five-year period of the top 40 JSE-listed firms. The first thing you notice is the predominant upward trend. Yes, there have been small dips in the growth, but the general direction is positive.

Even a major global event like the Covid-19 pandemic, pictured here around March 2020, wasn’t enough to halt growth. As quickly as that line drops, it climbs back up again, surpassing pre-pandemic levels less than 12 months later, and passing some of the highest points of 2017 and 2018.

It’s clear from this that the best way to deal with volatility is simply to avoid it altogether by remaining invested despite short-term market evidence to the contrary.

Warning: Undefined array key "id" in /data/www/html/octagon-financial/wp-content/plugins/graviton-post-importer/uncode/partials/elements.php on line 523

Octagon Financial

Share Article

Latest News

March 2024 Economic Review

April 11, 2024

Read this article on the Graviton Perspectives website. Click here.

Monthly Market Highlights – March 2024

April 9, 2024

Read this article on the Graviton Perspectives website. Click here.

Fund selection: When to hold ‘em and when to fold ‘em

April 8, 2024

Read this article on the Graviton Perspectives website. Click here.

Pre-MPC Analysis: a Hawkish pause expected

March 27, 2024

Read this article on the Graviton Perspectives website. Click here.

February 2024 Economic Review

March 11, 2024

Read this article on the Graviton Perspectives website. Click here.

Hedge Funds 101: Unpacking the essentials for smart investors

March 8, 2024

Read this article on the Graviton Perspectives website. Click here.

Monthly Market Highlights – February 2024

March 7, 2024

Read this article on the Graviton Perspectives website. Click here.

Unpacking the Budget Speech 2024

February 22, 2024

Read this article on the Graviton Perspectives website. Click here.

Monthly Market Highlights – January 2024

February 14, 2024

Read this article on the Graviton Perspectives website. Click here.

January 2024 Economic Review

February 12, 2024

Read this article on the Graviton Perspectives website. Click here.