Currency performance report

With unprecedented volatility, 2020 is set to make history. It has been the perfect storm with a rapid outbreak of Covid-19 combined with an untimely oil price war between Saudi Arabia and Russia. As the most liquid asset class, foreign exchange has been the quickest to respond to the potential impact.

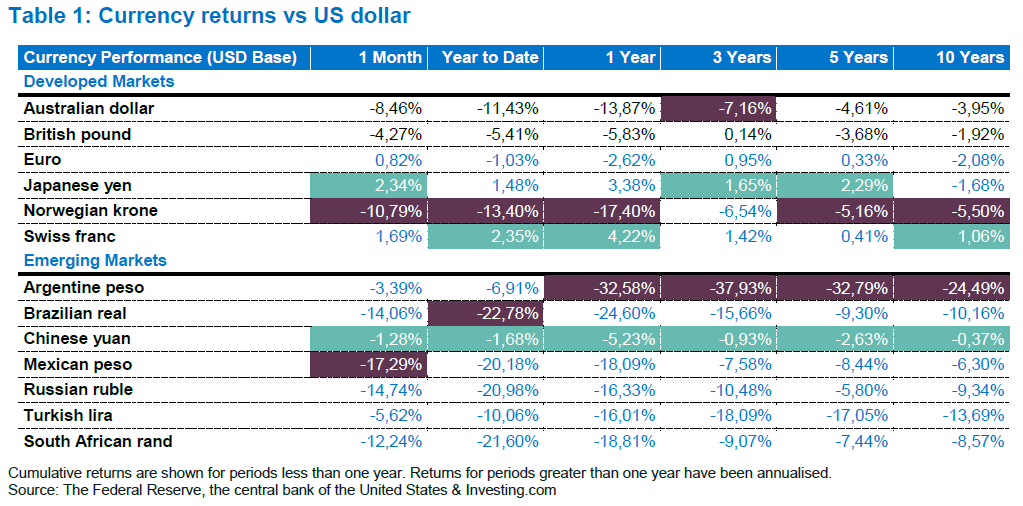

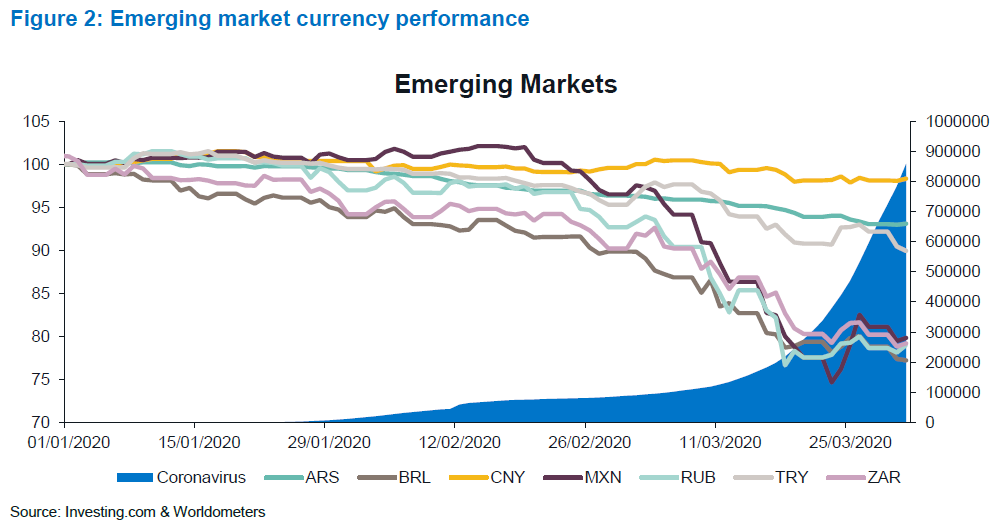

For the emerging market currencies measured, the Mexican peso has lost the most ground against the US dollar. This was driven by a rapid increase in Covid-19 cases in the United States and the two countries’ subsequent limitation on cross-border movement. Due to their close trade ties, this has hurt the Mexican peso. Over the longer term, the Argentine peso has consistently been the worst performer owing to the country’s continuous government defaults and increasing debt levels.

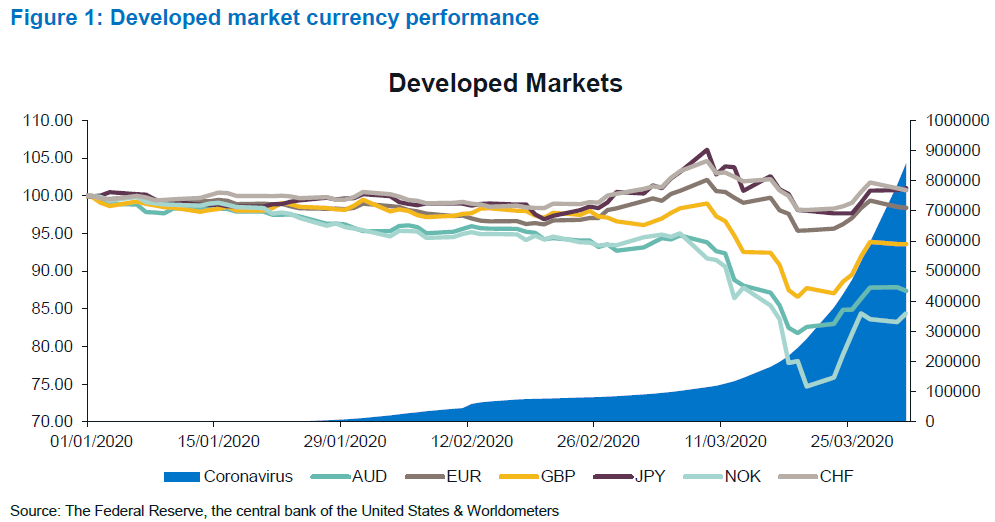

For the developed market currencies measured, the Norwegian krone has been the consistent underperformer. Most recently, the underperformance has been a result of a crash in the oil price. Due to the country’s reliance on oil this has caused substantial weakening of the krone versus the US dollar.

Apart from ‘safe currencies’ such as the Japanese yen and the Swiss franc, there was a general decline in currency performance relative to the US dollar as the global reported cases of Covid-19 increased. This effect was exacerbated by the general ‘risk-off’ sentiment of global investors, especially for emerging market currencies.

The following figures plot the year-to-date currency performance versus the total number of Covid-19 cases globally. The left y-axis measures the currency performance indexed to 100. The right y-axis follows the total Covid-19 cases over time.

Apart from Covid-19 the Norwegian krone was further negatively impacted by the ongoing oil price war between Saudi Arabia and Russia. The following figure plots the year-to-date currency performance of the krone versus the price of Brent oil.

In the first quarter of 2020 no currency was spared the devastating impact of the Covid-19 pandemic. In general, emerging market currencies fared worse than developed market currencies. The Australian dollar is an exception to the trend and, together with the Norwegian krone, was the worst performing developed market currencies for the month and year to date. This is due to Australia’s close trade ties to the Asian Pacific, specifically China, where the Covid-19 virus originated.

Comments are closed.